Business Overview

The development of indoor science and technology exquisite breeding technology and the isolation of external climate interference and disease sources can free the aquaculture benefits from the restrictions of natural conditions. At the same time, the land resources and water resources consumed by aquaculture are reduced, which is in line with the trend of environmental protection policies in various countries worldwide.

As artificial propagation is not available for eel and the number of fries in the world has dropped drastically in recent years while Asian countries' demand for eel ingredients has been steadily growing, the market prices have risen year by year. The black eel is the only species of eel that can be stably caught, and its breeding technology has a high threshold. For the common dealer, the average survival rate is less than 30%.

Our company spotted eel market opportunities, used exquisite indoor breeding to increase survival rate of black eel to above 80% and got a huge profit margin. In addition to self-operated farms, we also cooperate with existing farmers and centralized breeding, carry out the output of technology and equipment, and then purchase the output for external sales in a unified way to build the largest eel whole-industry chain enterprise in the Asia Pacific region.

At present, we have about 100,000 square meters of directly-owned premises in Taiwan and another 15 franchisees. We have already cooperated with a number of domestic existing farmers. We will build two 15-acre direct-sales areas by 2018, accept CCTV column media interview, and actively expand our own brands in the domestic market.

As artificial propagation is not available for eel and the number of fries in the world has dropped drastically in recent years while Asian countries' demand for eel ingredients has been steadily growing, the market prices have risen year by year. The black eel is the only species of eel that can be stably caught, and its breeding technology has a high threshold. For the common dealer, the average survival rate is less than 30%.

Our company spotted eel market opportunities, used exquisite indoor breeding to increase survival rate of black eel to above 80% and got a huge profit margin. In addition to self-operated farms, we also cooperate with existing farmers and centralized breeding, carry out the output of technology and equipment, and then purchase the output for external sales in a unified way to build the largest eel whole-industry chain enterprise in the Asia Pacific region.

At present, we have about 100,000 square meters of directly-owned premises in Taiwan and another 15 franchisees. We have already cooperated with a number of domestic existing farmers. We will build two 15-acre direct-sales areas by 2018, accept CCTV column media interview, and actively expand our own brands in the domestic market.

Transaction Overview

Through this round of financing, our company will establish the first brand in eel industry by copying Taiwan successful mode, building directly-owned premises, increasing yield through joint investments and expanding domestic market channels.

Investment Highlight

Our company is the only one that can ensure the pure living rate of the black eel is higher than 80%, in addition the company also has reproduction and inheritance experience of processes and technologies of complete cultivation SOP.

Aquaculture is an industry that will never go out of fashion. With sustained and steady growth needs, the valuations given by main boards in Shanghai Stock Exchange and Shenzhen Stock Exchange to relevant agriculture, fishery and animal husbandry enterprises are averaged over 60 times of price-earnings ratio. In addition, agriculture and fishery can combine with government's aid-to-the-poor policies and enter into IPO through green channels, so that the threshold of listing is lower and the listing speed is faster.

Developing commercial franchise cooperation mode based on agricultural technologies can effectively increase capital utilization efficiency. Compound annual growth rate of turnover in recent three years is increasing in triple, and the net profit margin of cultivation to sales is in 3 to 4 times.

As the supply-side reform and eco-friendly policies were domestically advocated, many of aquaculture producers were told to close in 2017 due to discrepancy with the environmental standards. In addition, the supply of traditional eel fry was very scarce at the end of 2017, and lots of producers have no seedling launching at the start of 2018, so now it is the best time for the company from wealth growth to market development.

Aquaculture is an industry that will never go out of fashion. With sustained and steady growth needs, the valuations given by main boards in Shanghai Stock Exchange and Shenzhen Stock Exchange to relevant agriculture, fishery and animal husbandry enterprises are averaged over 60 times of price-earnings ratio. In addition, agriculture and fishery can combine with government's aid-to-the-poor policies and enter into IPO through green channels, so that the threshold of listing is lower and the listing speed is faster.

Developing commercial franchise cooperation mode based on agricultural technologies can effectively increase capital utilization efficiency. Compound annual growth rate of turnover in recent three years is increasing in triple, and the net profit margin of cultivation to sales is in 3 to 4 times.

As the supply-side reform and eco-friendly policies were domestically advocated, many of aquaculture producers were told to close in 2017 due to discrepancy with the environmental standards. In addition, the supply of traditional eel fry was very scarce at the end of 2017, and lots of producers have no seedling launching at the start of 2018, so now it is the best time for the company from wealth growth to market development.

About Management Team

The founder has 27 years of aquaculture experience; as ecological breeding with recycled water was used in 2009, the survival rate of black eel breeding was steadily increased from 30% to more than 80%, and a reproducible standard aquaculture operating system was established; the founder has become the leading pioneer in ecological breeding of black eel. There are a total of 18 existing employees of Aquaculture Department.

In 2015, the general manager cooperated with the founder for the planning of the eel industry chain market, the scale of the company's aquaculture farms expanded 53 times within 2 years, the annual revenue of each farm increased by 150%, developed 15 partners of Taiwan district, the aquaculture scale cooperated with Taiwan has exceeded 500 mu, and the team members have developed from 6 to 150.

In 2015, the general manager cooperated with the founder for the planning of the eel industry chain market, the scale of the company's aquaculture farms expanded 53 times within 2 years, the annual revenue of each farm increased by 150%, developed 15 partners of Taiwan district, the aquaculture scale cooperated with Taiwan has exceeded 500 mu, and the team members have developed from 6 to 150.

About Our Product

1. Product program for existing farmers and franchisers:

- Black eel fries, proprietary breeding equipment, construction of site establishment and planning, breeding technique guidance.

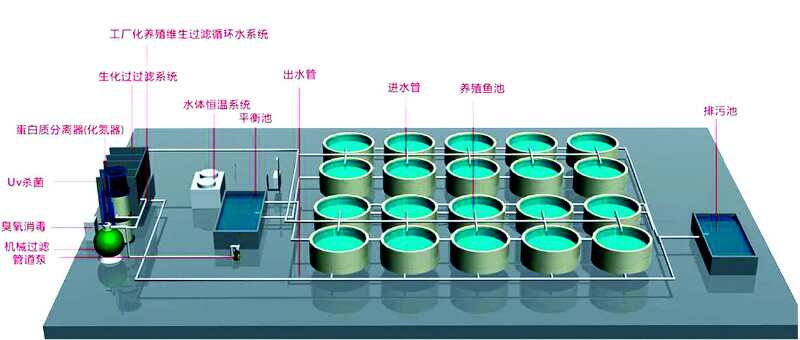

- High-end circulating water intelligent management system, intelligent solid-liquid separator, protein separator, ozone disinfection and sterilization system.

- Biochemical reaction and filtration system, UV disinfection system, efficiency augmentation system, constant temperature control system.

- Water quality online monitoring system (water temperature, PH value, redox potential, conductivity, salinity, ammonia nitrogen, nitrous parameters, etc.)

2. For foreign customers and domestic market orders:

Live eel, shallow processed products, deep processed products (Kabayaki), eel gift box

- Black eel fries, proprietary breeding equipment, construction of site establishment and planning, breeding technique guidance.

- High-end circulating water intelligent management system, intelligent solid-liquid separator, protein separator, ozone disinfection and sterilization system.

- Biochemical reaction and filtration system, UV disinfection system, efficiency augmentation system, constant temperature control system.

- Water quality online monitoring system (water temperature, PH value, redox potential, conductivity, salinity, ammonia nitrogen, nitrous parameters, etc.)

2. For foreign customers and domestic market orders:

Live eel, shallow processed products, deep processed products (Kabayaki), eel gift box

About Industry

China annually exports 40,000 ~50,000 tons of eel, making profit in foreign currency of more than USD 900 million, equivalent to the average price of RMB 140 Yuan per kilogram or so, which is much higher than other fishes in unit price and economic value.

Statistics shows that in 2015, China had a consumption of 25,000 tons, Japan of 80,000 tons, South Korea of 20,000 tons, and Europe and the United States also had a demand of tens of thousands of tons. According to the statistics, China’s consumption in 2017 had grown to 35,000 tons; with the trend of consumer upgrading, a potential bullish market will be seen domestically.

Statistics shows that in 2015, China had a consumption of 25,000 tons, Japan of 80,000 tons, South Korea of 20,000 tons, and Europe and the United States also had a demand of tens of thousands of tons. According to the statistics, China’s consumption in 2017 had grown to 35,000 tons; with the trend of consumer upgrading, a potential bullish market will be seen domestically.

Financials

A 15-mu aqua-farm area is conservatively estimated to harvest a total of more than 600 tons in five years, creating income of RMB 78 million Yuan calculated by RMB 130,000 Yuan per ton. The total input costs estimated in five years (including construction costs, aquaculture costs, management costs, etc.) is RMB 24.5 million Yuan.

A chain is realized for the whole industry, and the profit from finished eel processing to retail ranges from RMB 380,000-450,000 Yuan per ton and can also be increased another three times.

A chain is realized for the whole industry, and the profit from finished eel processing to retail ranges from RMB 380,000-450,000 Yuan per ton and can also be increased another three times.

About Competitor

In aquaculture techniques, China still has no successful precedent in black eel breeding, and is mainly provided by Japan, Europe and America; however, as the supply quantity of eel fry drops year by year, the costs rise greatly, without long-term competitive advantages.

In domestic brands, there are no widely-known brand enterprises in China, and traditional aquaculture producers are not good at brand operation, and the founder’s current goal is to build the top brand of eel in China.

In domestic brands, there are no widely-known brand enterprises in China, and traditional aquaculture producers are not good at brand operation, and the founder’s current goal is to build the top brand of eel in China.

Exit Strategy

For Registered Investors Only.

Risk Warnings

Disclosure: Investing in startups carries a high degree of risk. In general, financial and operating risks confronting both early and developmental-stage companies, as well as more mature expansion-stage companies are significant. Many emerging growth companies go out of businesses every year. It is difficult to know how companies will grow, if at all, or what changes may occur in the market. A loss of an investors entire investment is possible and no profit may be realized. Investors are responsible for conducting their own due diligence.

* It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities in this list

1. Product program for existing farmers and franchisers:

- Black eel fries, proprietary breeding equipment, construction of site establishment and planning, breeding technique guidance.

- High-end circulating water intelligent management system, intelligent solid-liquid separator, protein separator, ozone disinfection and sterilization system.

- Biochemical reaction and filtration system, UV disinfection system, efficiency augmentation system, constant temperature control system.

- Water quality online monitoring system (water temperature, PH value, redox potential, conductivity, salinity, ammonia nitrogen, nitrous parameters, etc.)

2. For foreign customers and domestic market orders:

Live eel, shallow processed products, deep processed products (Kabayaki), eel gift box

- Black eel fries, proprietary breeding equipment, construction of site establishment and planning, breeding technique guidance.

- High-end circulating water intelligent management system, intelligent solid-liquid separator, protein separator, ozone disinfection and sterilization system.

- Biochemical reaction and filtration system, UV disinfection system, efficiency augmentation system, constant temperature control system.

- Water quality online monitoring system (water temperature, PH value, redox potential, conductivity, salinity, ammonia nitrogen, nitrous parameters, etc.)

2. For foreign customers and domestic market orders:

Live eel, shallow processed products, deep processed products (Kabayaki), eel gift box

This section of information is for our registered investor only. Please Sign Up as a Shanghai Valley investor.

This section of information is for our registered investor only. Please Sign Up as a Shanghai Valley investor.

This section of information is for our registered investor only. Please Sign Up as a Shanghai Valley investor.

This section of information is for our registered investor only. Please Sign Up as a Shanghai Valley investor.